In employment cases damages are usually taxable.

Irs tax code flooring.

Sign your approval for section 179 your voice matters.

Department of the treasury treasury and the irs announced their intention to issue proposed regulations to help taxpayers comply with the changes made to the rules regarding the limitation on the deduction for business interest expense under section 163 j of the internal revenue code irc as a result of the tax cuts and jobs act tcja.

There the compensatory damages should be tax free under section 104 of the tax code.

Section 67 c of the internal revenue code of 1986 to the extent it relates to indirect deductions through a publicly offered regulated investment company shall apply only to taxable years beginning after december 31 1987.

Then select the activity that best identifies the principal source of your sales or receipts for example real estate agent.

In notice 2018 28 issued in april 2018 the u s.

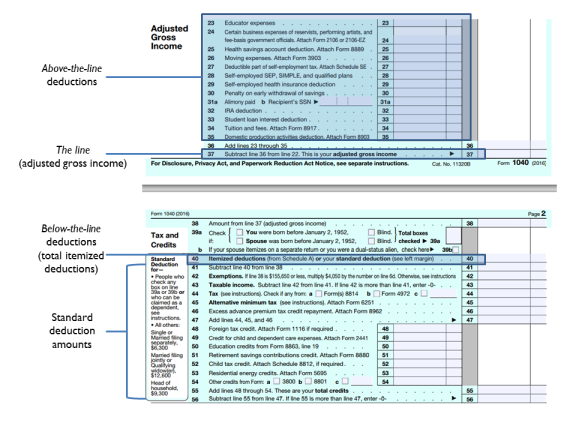

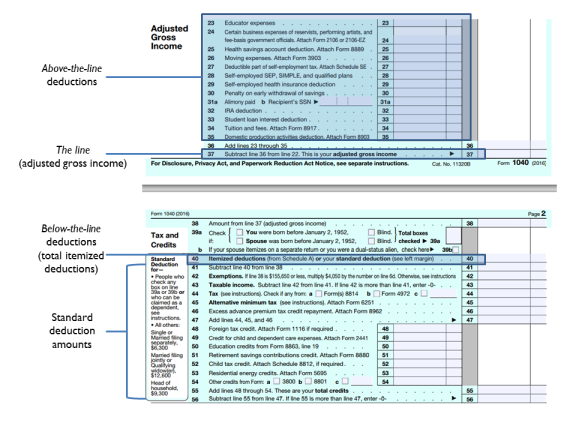

With respect to individuals section 67 disallows deductions for miscellaneous itemized deductions as defined in paragraph b of this section in computing taxable income i e so called below the line deductions to the extent that such otherwise allowable deductions do not exceed 2 percent of the individual s adjusted gross.

Irc 67 a states that a taxpayer can deduct miscellaneous itemized deductions only to the extent that the aggregate of such deductions exceed two percent of the.

A type of expenses subject to the floor 1 in general.

Property converted from business use to personal use in the same tax year acquired.

6412 a 1 tires and taxable fuel where before october 1 2022 any article subject to the tax imposed by section 4071 or 4081 has been sold by the manufacturer producer or importer and on such date is held by a dealer.

Internal revenue code 6412.

Property for which you elected not to claim any special depreciation allowance discussed later.

6412 a in general.

Property placed in service and disposed of in the same tax year.

Now find the six digit code assigned to this activity for example 531210 the code for offices of real estate agents and brokers and enter it on schedule c or c ez line b.

To amend the internal revenue code of 1986 to deny the deduction for advertising and promotional expenses for prescription drugs.

Other bonus depreciation property to which section 168 k of the internal revenue code applies.

In addition there are irs tax forms and also tools for you to use such as the free section 179 deduction calculator currently updated for the 2020 tax year.

Irs tax on legal settlements and legal fees.